Multi-Protocol Hopping

How Squid's multi-protocol hopping connects entire ecosystems

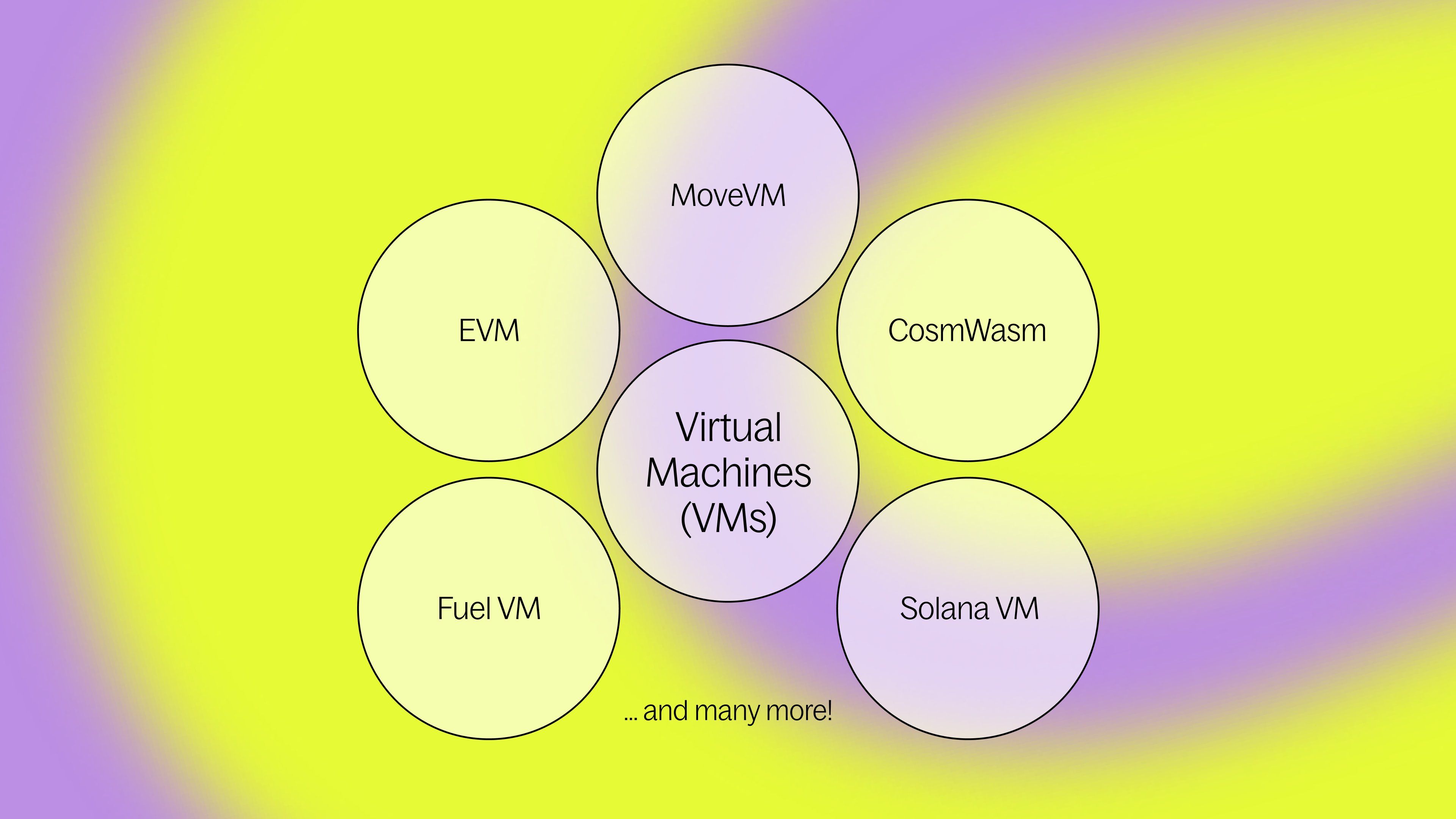

Squid now seamlessly connects four major blockchain ecosystems, each with their own distinct Virtual Machines: EVM chains, Cosmos, Solana and Bitcoin. Through Chainflip's integration, we're introducing a novel approach that makes these cross-ecosystem transfers possible: Multi-Protocol Hopping.

Chains vs Ecosystems

In crypto, an ecosystem represents a family of chains sharing the same fundamental architecture - their Virtual Machine (VM). The most well-known is the Ethereum Virtual Machine (EVM) ecosystem, which includes Ethereum and all EVM-compatible chains.

Bridging between chains within the same ecosystem (like Ethereum to Arbitrum) is relatively straightforward. The real challenge - and innovation - comes when bridging between different ecosystems, like moving assets from Bitcoin to Solana, or from Move-based chains to EVM chains. This is where Multi-Protocol Hopping becomes crucial.

The Single-Hop Problem

When moving assets between different ecosystems, traditional bridge aggregators often hit a wall. Here's why: while most aggregators can combine DEX liquidity with a bridge protocol, they're limited to using just one bridge per transaction. This "single-hop" approach becomes a problem because different bridge protocols support different sets of chains. Imagine trying to swap a Cosmos token for Bitcoin - if your aggregator's chosen bridge for Bitcoin doesn't support Cosmos as a source chain, you're simply stuck. No route found. This means users often need to:

- Navigate dead-ends when their preferred aggregator can't find a route

- Sign multiple transactions in their wallet

- Accept limited routing options and potentially higher costs

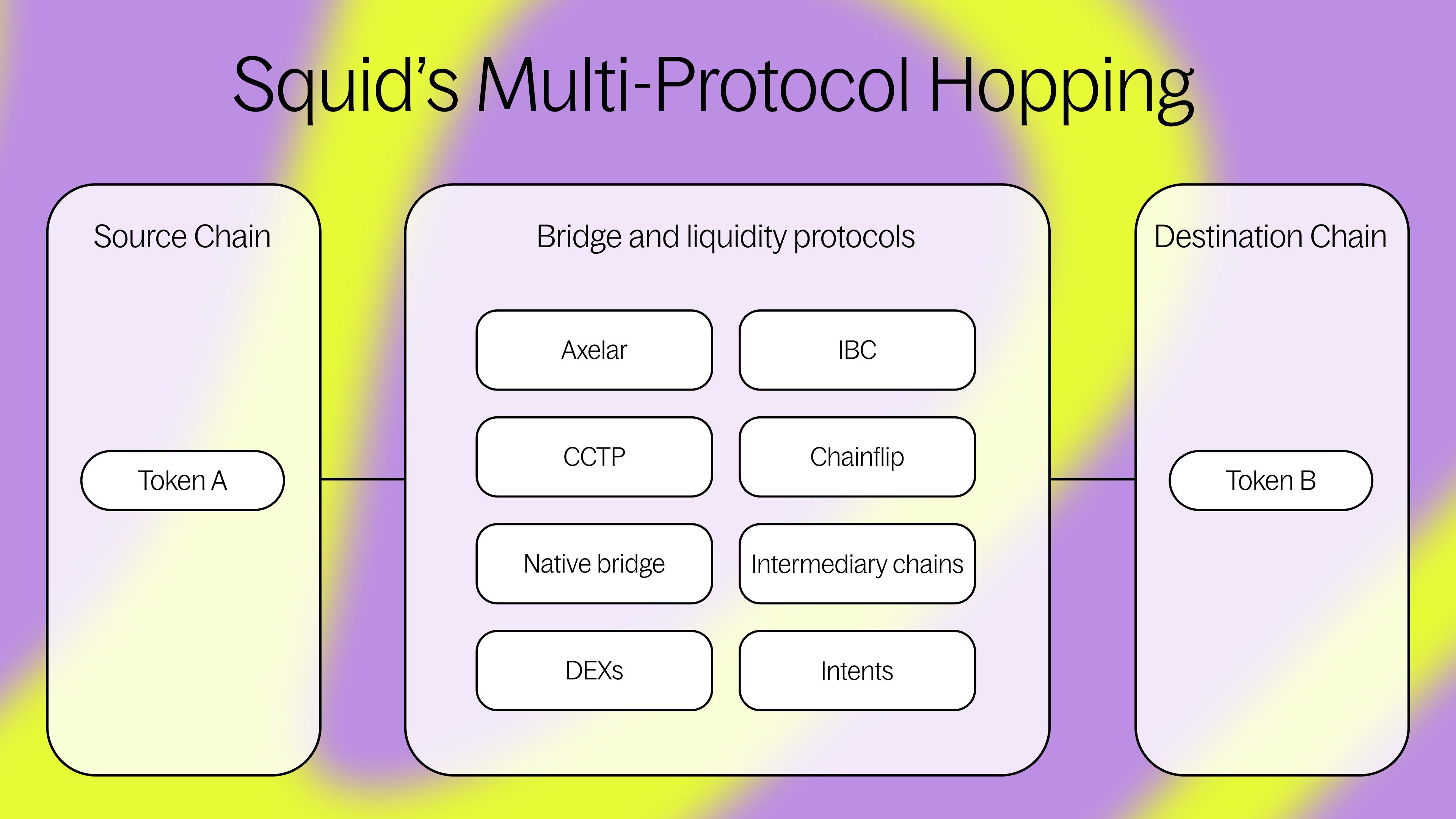

And so we thought… What if we widened the web and enlarged the network to function on a grander scale? What if a Squid-executed transaction could hop across separate bridging protocols, or even hop between cross-chain messaging protocols and interoperability layers? What if DEXs, native bridges, intermediary chains, and intents, were all seamlessly connected and equally accessible?

Squid's Multi-Protocol Hopping in Action

Multi-Protocol Hopping is our approach to cross-chain interoperability that exemplifies freedom and fluidity of passage by enabling simultaneous use of multiple protocols in a single transaction. Unlike other solutions that are restricted to one protocol, Squid can combine multiple bridging protocols (eg. Axelar, CCTP, IBC, Chainflip) and tap into DEX liquidity anywhere within a route in order to execute complex cross-ecosystem swaps with a single click.

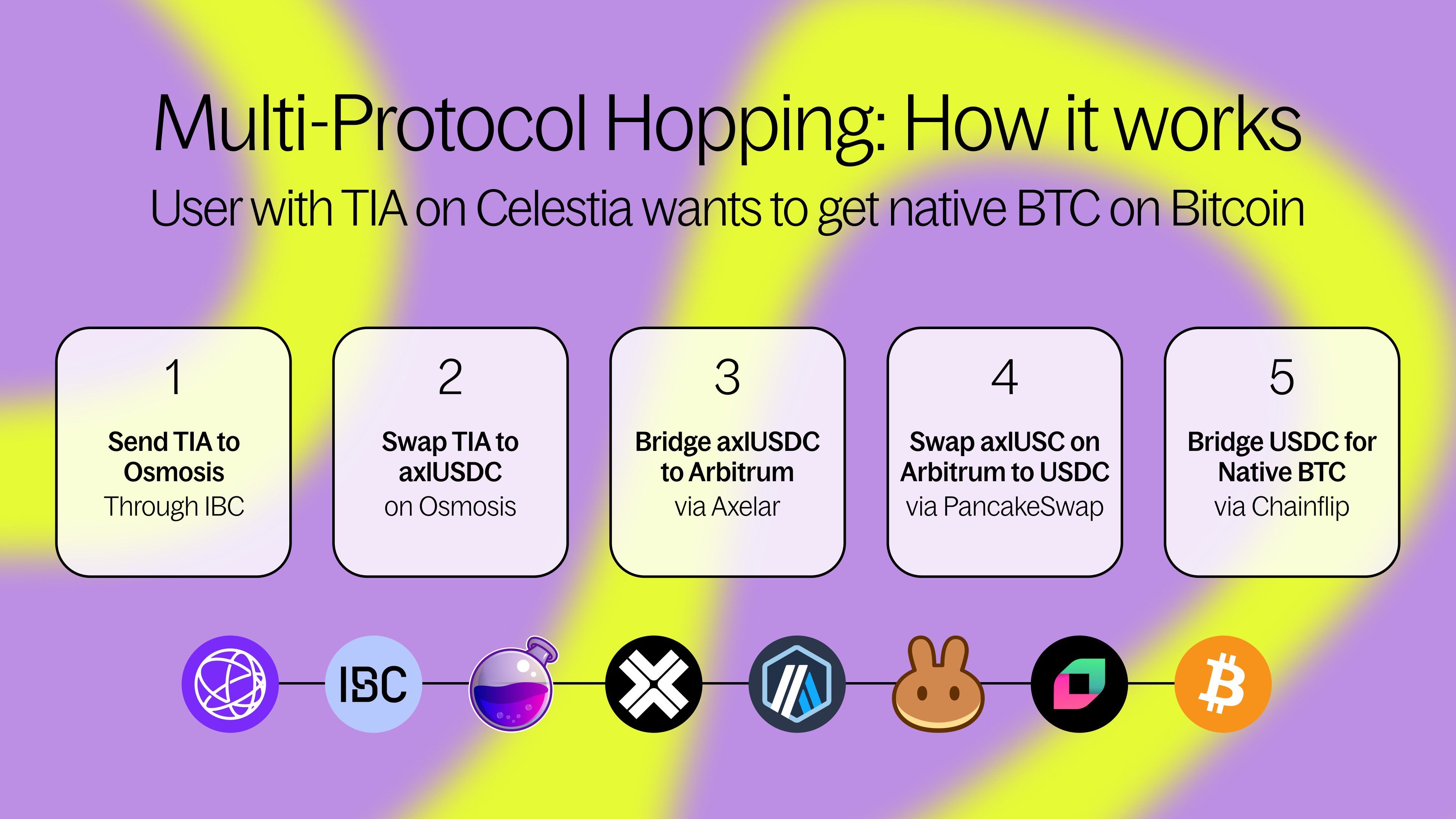

Let's see how this works with a real example. When a user wants to swap TIA on Celestia for BTC, here's what happens automatically:

TIA moves to Osmosis through IBC

TIA is swapped to axlUSDC via Osmosis

Axelar bridges axlUSDC to Arbitrum

axlUSDC is swapped to USDC via PancakeSwap

Chainflip swaps USDC on Arbitrum for native BTC

This example composes DEX liquidity, multiple bridging protocols, *and* an intermediary chain. All of this happens automatically within seconds. All you have to do is click "Swap."

CORAL: Where Onchain Meets Off-Chain

Squid's approach to cross-ecosystem transfers goes beyond just combining existing bridges. Through CORAL, our own intent-based system, we've added another powerful route to the mix. By treating CORAL as another protocol in the Multi-Protocol Hopping system, we can seamlessly blend on-chain and off-chain liquidity sources. This means when your transaction combines CORAL with other bridges and liquidity sources, you get access to the widest possible range of chains and tokens with optimized routing and costs. Learn more about CORAL here.